In both the Budget, and in a Downing Street Statement on 17th March 2020, Chancellor Rishi Sunak set out a number of measures to help individuals with the threats faced by Coronavirus.

The Chancellor has made clear that our NHS will have the resources it needs, and that we will do whatever we can to support individuals and businesses.

To support public services:

- A £5 billion Coronavirus Response fund for

- The NHS to treat Coronavirus patients, including maintaining staffing levels.

- Local Authority actions to support social care services and vulnerable people.

- Ensuring funding is available to other public services so that they are prepared and protected.

- £40 million of new funding for the National Institute for Health Research and the Department for Health to enable further rapid research into Coronavirus - this follows the £91 million that the government has already pledged to the international response.

- £7 bn extra for the Welfare System.

- £1.6bn of additional funding to support local authorities in responding to the Covid-19 pandemic. This will be delivered to them on the 3rd April.

To support people affected by Coronavirus:

- For those in difficulty due to coronavirus, mortgage lenders will offer at least a three month mortgage holiday. These people will not have to pay a penny towards their mortgage whilst they get back on their feet.

- Statutory Sick Pay (SSP) will be available for anyone diagnosed with Coronavirus, or who is unable to work became they are self-isolating from day 1, instead of day 4 for affected individuals. Those not eligible for SSP, or those earning below the Lower Earnings Limit of £118 per week, can make a claim for Universal Credit or Contributory Employment and Support Allowance more easily, which will be paid from day 1.

- People will be able to claim Universal Credit and access advance payments upfront without the current requirement to attend a Job Centre if they are advised to self-isolate.

- For the duration of the outbreak, the requirements of the Universal Credit Minimum Income Floor will be temporarily relaxed for those with Coronavirus, or those self-isolating, ensuring self-employed claimants will receive support.

- People who are advised to self-isolate will soon be able to a sick note by contacting NHS 111, rather than visiting a doctor when employers require evidence.

- Universal Credit standard allowance increased by £1000 a year, for the next 12 months.

- Self-employed assessment payments deferred to January 2021, from July 2020.

- A brand new Job Retention Scheme which enables employers to access extra funding, in order to keep paying their staff, regardless of the circumstances. This scheme can be used to maintain any job, in any sector of the economy, by paying up to 80% of the employees' base salary. The payments are capped at £2,500 per worker.

- Suspending the minimum income floor for twelve months means that self-employed people can now access, in full, Universal Credit at a rate that is equivalent to Statutory Sick Pay for employees.

- A delay to bringing in changes to IR35, from April 2020 until April 2021, giving self-employed people more time to prepare for the reforms.

- New emergency measures with the energy industry will protect those most in need. Customers with pre-payment meters who may not be able to add credit can speak to their supplier about options to keep them supplied, benefitting over 4 million customers. More broadly, any household in financial distress will be supported by their supplier, which could include debt repayments and bill payments being reassessed, reduced or paused.

- The new Self-Employment Income Support Scheme will provide taxable grants to self-employed individuals, including members of trading partnerships, worth 80% of their trading or partnership profits up to a maximum cap of £2,500 per month.

- The Self-Employment Income Support Scheme will cover three months of an individual’s typical profits so an individual could receive up to £7,500. HMRC will use the average annual profits from eligible individuals’ tax returns for 2016-17, 2017-18 and 2018-19 to determine the size of the grant for each person.

- Vehicle owners will be granted a 6 month exemption from MOT testing, allowing them to continue to travel to work where this absolutely cannot be done from home, or to shop for necessities. All cars, vans, and motorcycles which would usually require an MOT test will be exempted from needing a test from 30 March 2020

New measures will extend visas, under the same immigration conditions, for foreign nationals already in the UK and who are unable to return home, until at least 31 May 2020.

Visa nationals who cannot leave the UK before the expiry of their leave due to travel restrictions or self-isolation, must contact our Coronavirus Immigration Team (CIT) by email to advise of their situation. The email address is: CIH@homeoffice.gov.uk .

To support people in the high-risk category

- The NHS has identified that there are up to 1.5 million people who are extremely vulnerable to the COVID-19 virus due to their medical status. From this week, those identified will be contacted by letter and, where possible, text and advised to stay at home and avoid face to face contact for at least the next 12 weeks to protect themselves.

- The Government is setting up a local support system for those that cannot use friends and family to get their basic supplies.

- People who have been identified as extremely medically vulnerable will be able to access this delivery package through a specific website and hotline. We will deliver this in partnership with Local Authorities, Local Resilience Forums, the food suppliers and voluntary organisations. There will be no charge for the standard box of supplies.

- Community pharmacies will ensure those in this group that need medicines will get them.

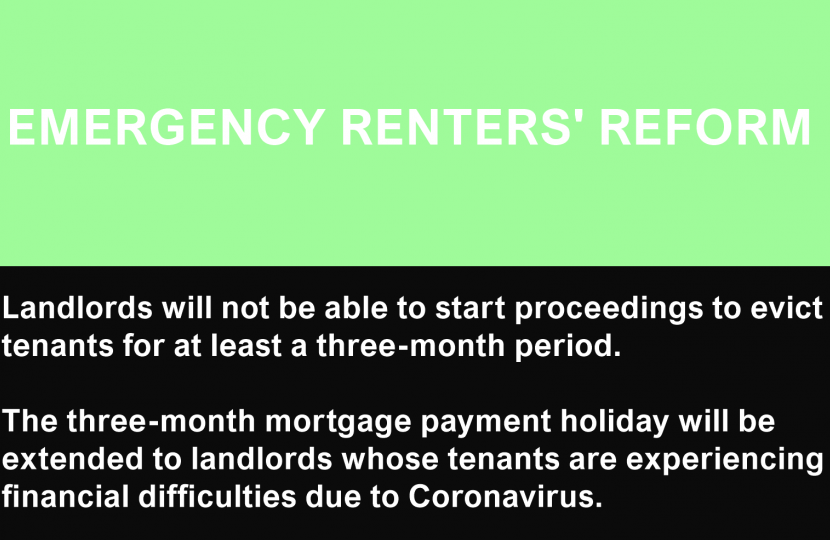

To support people renting in the private or social sector

- Emergency legislation as an urgent priority so that landlords will not be able to start proceedings to evict tenants for at least a three-month period.

- A moratorium on all new evictions and clear guidance has been issued stating that existing eviction processes should be dealt with appropriately, prioritising the safety and health of citizens across the country.

- The Government has worked with the Master of the Rolls to widen the ‘pre-action protocol’ on possession proceedings, to include private renters and to strengthen its remit. This will support the necessary engagement between landlords and tenants to resolve disputes and landlords will have to reach out to tenants to understand the financial position they are in.

- The three-month mortgage payment holiday announced previously will be extended to landlords whose tenants are experiencing financial difficulties due to Coronavirus.

- 1 bn extra to help renters affected by Coronavirus.

- £500 million Hardship Fund to provide support, including council tax relief, in 2020 to 2021 to those who need it most.